Blog Search

Categories

Searching Blogs......

Refundable Excess - Frequently Asked Questions

Recently we’ve been receiving a lot of questions and feedback regarding our Excess Refund products, our Full Damage Protection and Full Damage Protection with Breakdown Cover . In order to help clients understand what it is and what it does, we’ve put together some of the most frequently asked questions.

What does excess mean?

The vehicle’s basic insurance limits the driver’s responsibility to a certain amount, which is called an excess. For instance, say a car has an excess of €300 and there’s accidental damage amounting to €500. In that situation, the driver is responsible for paying the €300 of the excess and the car’s insurance covers the rest. The value of the excess varies depending on the supplier and the car category, and you can normally find that information in our booking engine, under “Product Information”.

What is Full Damage Protection?

The Full Damage Protection option is a service provided by Auto Europe that allows clients to claim a reimbursement of the excess amount in case of accidental damage.

Does that mean I still need to pay for it to the supplier?

Yes, in case of accidental damage to the vehicle for which you need to pay the excess amount, you will pay for it to the supplier and you can then claim a refund from Auto Europe.

What is the advantage of getting Full Damage Protection from Auto Europe rather than getting extra insurance to reduce the excess from the supplier?

Two main reasons. First, you can book and pay for it online in advance and not have to worry about whether or not the supplier provides the option and about having to pay for it locally. Secondly, even if the supplier does provide such an insurance, Auto Europe’s Full Damage Protection tends to be significantly cheaper than options provided locally.

If I have Full Damage Protection from Auto Europe, do I still need to leave a deposit?

Yes. The Full Damage Protection service from Auto Europe does not eliminate the supplier’s excess and you will still need to leave a security deposit.

The local staff says I really should take on additional insurance with them even if I have Auto Europe’s Full Damage Protection. Should I?

It’s important to understand that local staff are salespeople and, as such, they quite naturally try to sell their own products. Whether or not you acquire further insurance is entirely a matter of personal preference, and except for very specific situations, all the insurance offered locally is optional. If you are offered additional insurance to reduce the excess, then it is probably redundant to take it on top of the Full Damage Protection. They may also offer insurance to cover elements not covered by the basic insurance, such as tyres, glass, etc., in which case it’s up to the client to determine whether or not they find that necessary for their own peace of mind.

So the Full Damage Protection does not cover the entire car?

The Full Damage Protection covers the excess left by the basic insurance and, as such, the same exclusions apply. While the exact exclusions may vary depending on the category and supplier, they usually are as follows: interior, underside and roof of the vehicle. You can find a complete list of exclusions in the description of the product in our booking engine and on the Terms and Conditions of your voucher.

What do I need to do to claim a refund from Auto Europe?

You can find a detailed description of the procedures by clicking here. Please note that it is extremely important to contact the police and obtain an incident report, even if no other vehicles were involved.

I want to add Full Damage Protection cover to my booking but I don’t see an option online. What do I do?

Full Damage Protection cover is not available for all cars and locations. When available, you are given the option to add it to your booking before proceeding to payment.

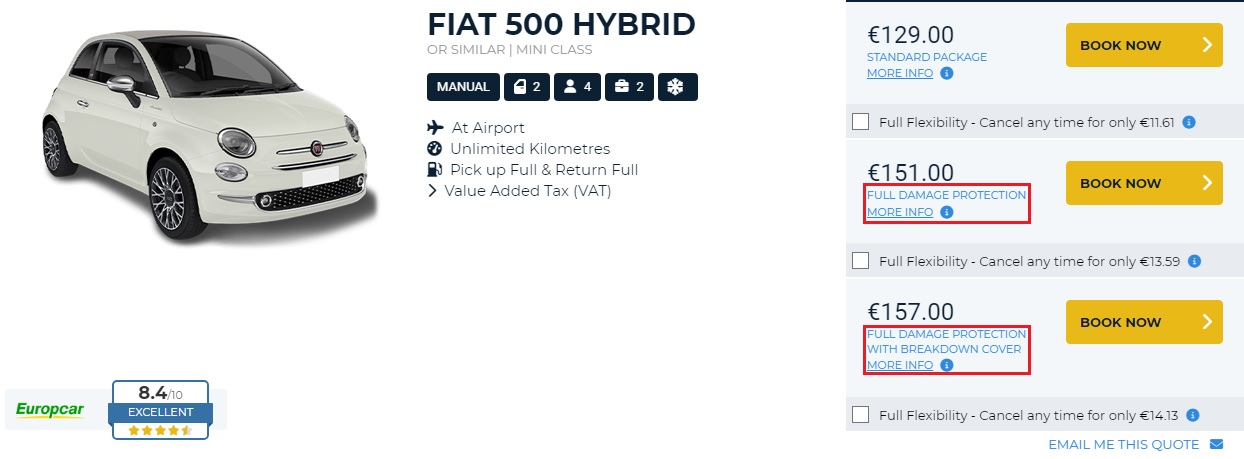

Full Damage Protection and Full Damage Protection with Breakdown Cover can be found listed on our booking engine:

Do I always have to pay for the Full Damage Protection option if I want to add it to my booking?

No. Sometimes Auto Europe includes Full Damage Protection as part of the standard package and you don’t need to pay anything extra for it. When that is the case, we display that information in the search results in our booking engine. If you like, you can even filter the results to display only those that already include Full Damage Protection/Zero Excess in the price.

Are Full Damage Protection and Zero Excess the same thing?

No. Zero Excess, where available, eliminates the excess entirely. To learn more about Zero Excess and Full Damage Protection, find out more in our in-deoth blog post.

Blog Search

Categories

- Home

- Travel Blog

- Refundable Excess - Frequently Asked Questions